US Customs and Border Protection (CBP) has issued guidance on completing origin declarations, origin statements, and certificates of origin. These documents must be completed and signed by an official of the importer, exporter, or producer or agent of the importer, exporter, or producer having knowledge of the relevant facts to the origin of the goods, as specified by the respective trade preference program.

CBP has observed an increase in the use of consignee information where importer information is required; specifically, when the consignee is not the importer of record (IOR). The importer must be the actual IOR. If a consignee is not the IOR, the consignee may NOT be listed as the importer on the origin declaration, origin statement, or certification of origin.

A claim for preferential tariff treatment may be denied if an importer fails to submit, when requested by CBP, the completed origin declaration, origin statement, or certification of origin prepared in accordance with the requirements of the trade preference program.

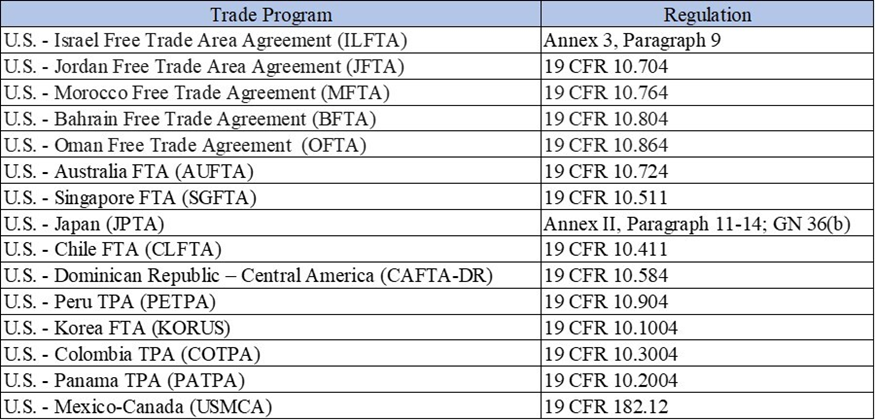

For more information on origin declarations, origin statements, certifications of origin requirements, see references below:

Questions regarding this notice may be directed to the Office of Trade, Trade Agreement Branch at FTA@cbp.dhs.gov.

This information is derived from the CBP CSMS #60588866.