At last count, your company is sourcing from 35 foreign suppliers, located on five of the seven continents, and the number is growing quickly. With the amount of suppliers increasing, it’s a good idea to create a foreign supplier database that can be used by a number of departments. To gather information for this task, you head to the accounts payable department to pick up some invoices.

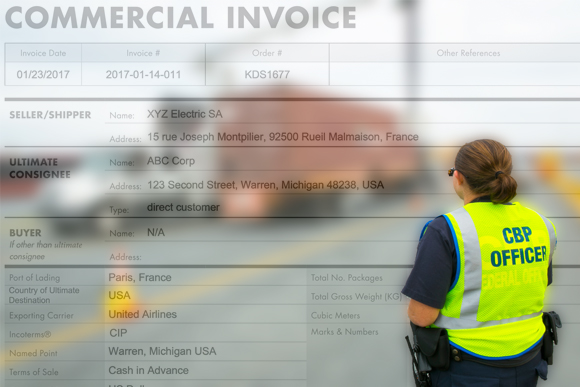

What you find stops you in your tracks. The commercial invoices do not have consistent formats. Some invoices indicate Incoterms, whereas others do not. There are even invoices that are completely in Spanish, handwritten, or incomplete.

How can these inconsistencies be corrected to ensure more uniformity? Fortunately, there is a solution—send your suppliers detailed instructions of what is mandatory on the commercial invoice [1]. This may sound simple, but getting the supplier to adhere to the requirements could prove challenging.

Communicating Requirements

Liquidated damages—monetary penalties—can be assessed against an importer for failing to provide a commercial invoice [2]. This can happen if Customs is at your facility performing a formal audit or if they request a hard copy of the commercial invoice for any entry, at any time. A shipment cannot be cleared by Customs without an invoice. Therefore, it is imperative to have a proper commercial invoice to avoid penalties and delays in clearance.

The requirement for an accurate commercial invoice should be incorporated into your import compliance manual and processes. Your procedure ought to include a way to communicate the requirements to the supplier, a process for monitoring the supplier’s paperwork, and a protocol to follow for when the requirements are not met.

While obtaining an invoice for every imported shipment may seem an obvious requirement [3], suppliers often create their own version of the document. This could be in the form of a packing list to which pricing information has been added, a pro-forma invoice [4], or their own invoice template. They may tell you they have “always done it this way;” however, none of the above supplier-created documents are acceptable replacements for a commercial invoice. This is why it is crucial to make the requirements clear to your supplier, which can be communicated in the purchase order, shipping instructions, or sales contract.

Exceptions

While there are few cases where a commercial invoice is not required, at minimum a U.S. importer must still present some sort of confirmation of the value of a shipment. There are also circumstances where invoice requirements may be waived by U.S. Customs, but the process to obtain a waiver is cumbersome and can cause clearance delays.

As a compliance best practice, it is recommended that you require suppliers to provide a commercial invoice for all U.S. import shipments, regardless of exceptions. Advising your suppliers that it might assist in expediting the payment process, could motivate them to comply with this request.

The Importance of Correct Value

The most important requirement to be aware of is reporting the correct value of a shipment at time of entry. It is the importer’s legal responsibility to declare the correct value, classification, and rate of duty [5]. An accurate commercial invoice will help to ensure the correct value is reported to U.S. Customs.

One way to ensure this is to compare the entered value shown on the U.S. Customs entry, against the amount your company paid to the supplier for that specific shipment. Any mistake, damage, overage, shortage, etc. that creates a discrepancy between the amount paid to the supplier—no matter when it’s paid and when it’s discovered—and the amount reported to U.S. Customs, requires that the entry be amended to show the actual value imported. If the two values do not match, corrective action—which may include advising U.S. Customs of the error—is required. Your company may want to contact a Customs attorney to discuss the best approach to this.

You may be wondering why this matters in today’s electronic environment, where hard copy documents are rarely, if ever, presented to U.S. Customs at time of entry. Even with electronic documents, discrepancies between the declared value and the payment amount often remain out of sight, until U.S. Customs arrives for an audit. Should that happen, it will do no good to explain why a system of checks and balances is not in place and why no corrective action has been taken.

The regulations are unmistakable; unless your situation qualifies for an exemption or you wish to pursue a waiver from U.S. Customs, a commercial invoice must be provided in order to be cleared by U.S. Customs. However, an inaccurate or incomplete commercial invoice is one of the most common errors found during a U.S. Customs audit. In order to avoid penalties and fines, importers need to ensure that their commercial invoices, or pro-forma invoices—in certain cases—meet all U.S. Customs requirements. By issuing instructions to suppliers, importers can help ensure the commercial invoice is accurate.

Click here to download our invoice checklist.

We can help you develop or improve your import compliance programs. For guidance on incorporating procedures about commercial invoices into your current compliance program, contact Mohawk Global Trade Advisors.

Footnotes:

[1] See 19 CFR §141.81-141.90 (2017) for commercial invoice requirements.

[2] See 19 CFR § 171 App. B (D)(6) (2017)

[3] Per 19 CFR §141.81 (2017), “A commercial invoice shall be presented for each shipment of merchandise at the time the entry summary is filed.”

[4] A pro-forma invoice is acceptable only in certain circumstances as detailed in 19 CFR § 141.83(d) (2017). Many suppliers mistakenly provide a pro-forma invoice in place of a commercial invoice. Click here to see an example of a pro-forma invoice.

[5] See 19 USC § 1484(a) (2017)

By Adrienne Graddy

©2016 Mohawk Global Trade Advisors