With eleven straight months of volume growth behind us, and no immediate end of sustained consumer demand in sight, ocean carriers and marine terminals continue to choke on the sea of import containers coming into U.S. ports.

The COVID-19 virus caused intermittent labor shortages, by impacting drivers and longshoremen, and severely disrupted terminal efficiency and delivery schedules. Additionally, displaced equipment from the initial lockdown—rail cars, chassis, containers, and idled vessels—resulted in equipment shortages that continue to exacerbate the landside congestion, almost a year later.

While the system was slowly adapting and recovering, the grounding of the Ever Given—the ship that had run aground in the Suez Canal in March—set it back a bit. Still, with every available containership deployed, and displaced equipment notwithstanding, the system continues to face ever-growing demand. In simple economic terms, demand has outstripped supply, so freight rates continue to climb. At the same time, service levels have never been lower.

The Impact

When vessels began stacking up in the anchorage outside the ports of Los Angeles and Long Beach, cargo owners and logisticians looked to other gateways to move cargo. This prompted heavy congestion in other West Coast ports, then Gulf ports, and ultimately East Coast ports. Anchored vessels delayed return trips to Asia that resulted in involuntary void sailings, while the carriers struggled to put their vessels back into rotation.

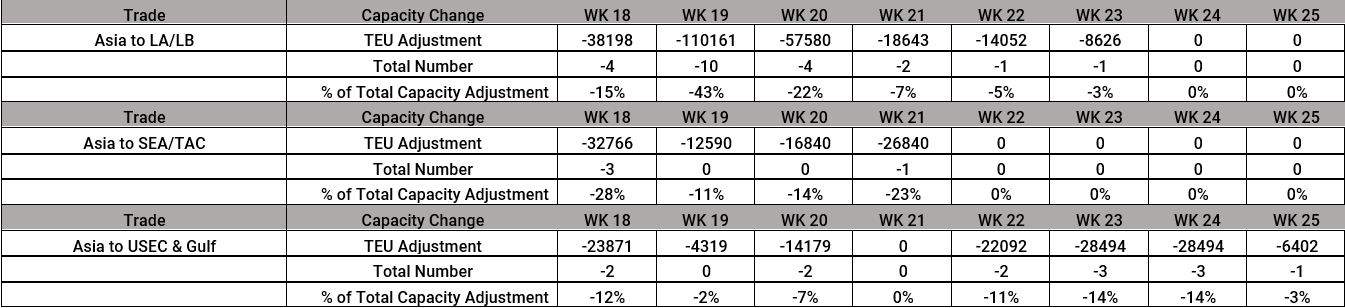

The Ever Given grounding had a similar effect on East Coast schedules, prompting the void sailings we are seeing now. The below chart is indicative of improvement we are seeing in southern California ports for upcoming weeks, while departures to U.S. East Coast ports will be negatively impacted in upcoming weeks.

The Forecast

Economists continue to forecast heavy demand for hard goods through the third quarter this year, and possibly longer. The good news is a shift in discretionary spending is anticipated as we reach a higher degree of herd immunity, which will result in more travel and entertainment spending, thereby reducing retail demand. Until that change occurs, we are likely to see more of the same patterns remain.