Before we can tackle country of origin, we first must take a step back in history to understand its roots.

In 1994 Congress passed the Customs Modernization Act, also known by its abbreviation Mod Act. A legal requirement of the Mod Act obligates importers to exercise reasonable care when importing goods into the United States (the fifty states, District of Columbia and Puerto Rico).

Duty of Importers

An important requirement of reasonable care is rules of origin. What exactly are rules of origin? Simply put, these rules that legally obligate importers to determine the country of origin for merchandise that they import into the United States.

Rules of origin legally shift responsibility from U.S. Customs and Border Protection (CBP) to importers, making it the importer’s responsibility to provide CBP with accurate information regarding not only country of origin, but also admissibility, tariff classification, and value of the imported goods. To be fully compliant, importers must also ensure the merchandise is marked conspicuously, legibly, indelibly, and permanently with the country of origin, plus ensure that the correct country of origin is on the Customs documents. Marking cannot happen until country of origin is determined.

Country of Origin Challenge

Sounds easy enough, right? Not so fast. Determining the country of origin can be quite a complicated undertaking because of today’s complex, globalized supply chains and growing trade business among many countries of the world. However, it is something that all parties involved in importing merchandise into the United States must do.

First and foremost, it cannot be overemphasized enough: country of origin does not always equal country of exportation.

According to CBP, the country of origin is determined by “the country of manufacture, production, or growth of any article of foreign origin.” Considering that a particular article can have raw materials and parts sourced from multiple countries, and then subsequently undergo manufacturing and processing in others, it’s easy to see how

difficult it can be to make the final determination of that article’s country of origin. But it must be determined—and determined accurately. Unmarked or inaccurate markings can turn into profit-killing border delays or detainments, lost sales, third-party warehouse service fees, fines or penalties, and even outright entry denials.

difficult it can be to make the final determination of that article’s country of origin. But it must be determined—and determined accurately. Unmarked or inaccurate markings can turn into profit-killing border delays or detainments, lost sales, third-party warehouse service fees, fines or penalties, and even outright entry denials.

Substantial Transformation Test

Applying the substantial transformation test is the principle legal way to determine country of origin. Unfortunately, this is not a foolproof test that can be applied across the board for all products that originate in multiple countries. This test must be applied on a case-by-case basis.

According to the CBP, “an article that consists in whole or in part of materials from more than one country is a product of the country in which it has been substantially transformed into a new and different article of commerce with a name, character, and use distinct from that of the article or articles from which it was so transformed.”

Let’s look at an example for a popular consumer item – jeans. Approximately 450 million jeans are sold in the U.S. each year. Did you ever stop to think about the journey they take? By the time jeans enter the U.S., they could have feasibly traveled up to 40,000 miles. Here are a few steps along the way:

- Cotton is grown in and sourced from India, Pakistan, Korea, Hungary or Northern Ireland

- Pumice stone (stonewash) is sourced from Turkey

- Cotton is dyed in Spain

- Brass rivets are sourced from Germany

- Zippers are sourced from Japan

- Jeans are manufactured in Tunisia

As you can see, jeans have parts sourced in certain countries, components from others, and processing in additional countries. However, the country of origin is Tunisia because this is where the substantial transformation took place, resulting in the end product – jeans.

Free Trade Agreements

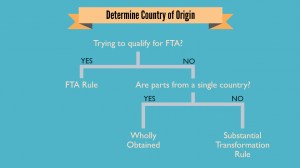

Understanding the country of origin also helps you to determine if your merchandise qualifies for preferential treatment under one of the several Free Trade Agreements and associated specific rule of origin.

What Can Be Done Prior to Import

It is highly recommended that importers of merchandise—that does not originate wholly from one single country—into the United States seek guidance and consultation from a licensed Customs broker, an attorney, or accountant to help navigate the plethora of regulations and applicable laws, and to ensure compliance.

Importers can also consult CBP’s U.S. Rules of Origin compliance publication.

Need help ensuring your products are compliant? Contact one of our many expert trade advisors.

By Yvonne Scott-Younis